مخطط تفصيلي

- مقدمة

- How Are the “Hottest” Lighting Products on Alibaba Identified?

- What Are the Top 10 Hottest Lighting Products on Alibaba International in 2025?

- How Do Price Competition, Certification Barriers, and Lifecycles Compare Across These 10 Categories?

- Why Are Lighting Accessories the Real Profit and Strategy Drivers in B2B Trade?

- How Should Buyers and Manufacturers Position for Alibaba Lighting Growth in 2026? Key Takeaway

- الكلمات النهائية

If you are about to buy some lighting solutions, understanding lighting trends on Alibaba International can help you make a prudent decision. Because they reflect real buying decisions, not predictions. Alibaba International Station aggregates millions of RFQs from global buyers every year.

These RFQs reveal:

- What projects are funded?

- What specifications are demanded?

- Which products are moving at scale?

Across regions, procurement is shifting from simple purchases. Sourcing is completed as per the project needs. Buyers now prioritize certified and standardized lighting solutions.

Low-cost fixtures alone are no longer enough. Intelligent controls and extended reliability now define competitive lighting products in global B2B trade.

How Are the “Hottest” Lighting Products on Alibaba Identified?

RFQ trends

On Alibaba International, hot products are defined by real demand, not surface visibility. The clearest signal is high-frequency RFQs. Lighting categories with repeated buyer requests command attention because RFQs represent serious purchase intent from global buyers. RFQ trends give a direct view into demand patterns and unmet needs.

| فئة المنتج | RFQ Frequency | Avg. RFQ-to-Order Conversion | Typical Buyer Type |

| LED Street Lights | عالية جدًا | عالي | Municipal / EPC |

| LED Flood Lights | عالي | واسطة | Commercial / Contractors |

| Solar Street Lights | عالي | متوسط-عالي | Government / NGOs |

| LED Bulbs | عالية جدًا | قليل | Traders / Distributors |

| Photocells & Controllers | واسطة | عالية جدًا | EPC / Utilities |

Product Status

Next, Alibaba data shows that product saturation matters. Categories with high RFQs but fewer quality suppliers indicate less competition and a higher opportunity. Meanwhile, segments that win repeat and large project orders tend to be infrastructure or B2B-grade products.

Certification requirements like يو ال, م، و مؤسسة الإمارات للطاقة النووية also correlate strongly with sustained reorder volume.

Together, these metrics explain why infrastructure and control-related lighting products rank higher than basic fixtures.

What Are the Top 10 Hottest Lighting Products on Alibaba International in 2025?

LED Street Lights are the Backbone of Municipal and Infrastructure Projects

LED street lights lead outdoor lighting worldwide. Street lighting accounts for a large share of outdoor LED markets due to energy savings and urban rollout plans.

Buyers seek:

● Power range

Typically 30W–200W with modular optics.

● تصنيفات IP

IP65+ for all-weather use.

● Materials

Die-cast aluminum for heat dissipation and durability.

Major importers include Asia and North America as governments pursue energy efficiency. Pairing street lights with smart عناصر التحكم الضوئية and IoT interfaces boosts value by enabling adaptive dimming and remote monitoring. This combination also supports smart city energy goals.

LED Flood Lights Dominating Commercial and Retrofit Demand

LED flood lights are notable for versatility and robust lumen output. Commercial spaces and retrofit projects drive bulk orders.

They are suitable for large areas. Their IP ratings are high. Motion and smart التحكم في الإضاءة readiness further increase energy savings.

Flood lights now compete globally. Their wired and solar variants are gaining traction. Alibaba B2B buyers often choose models with integrated motion sensors or smart dimming for energy optimization in commercial settings.

Solar Street Lights Exploding in Remote Areas and Emerging Markets

There is a rapid B2B demand growth for solar lights. This uptick is especially visible in regions with unreliable grid power. These lights are forecasted to grow strongly due to sustainability goals and operational cost savings.

Buyers evaluate:

● Integrated vs. split systems

Integrated simplifies install; split optimizes panel placement.

● Competitive edge

Smart controllers and motion sensors reduce wastage.

● Applications

Parks, rural roads, campuses, and smart infrastructure.

Solar variants combine renewable energy and LED efficiency. This makes them ideal for off-grid and green city projects.

LED High Bay Lights Remain an Industrial Bestseller

LED high bay lights serve warehouses, factories, and logistics hubs. These environments demand powerful, reliable lighting at height. Market data show industrial lighting retrofit continues to accelerate.

Buyers prioritize:

- Stable demand consistent with automation and warehouse expansion.

- Certifications like UL and ENEC ensure safety and compliance for big projects.

- زاغا compatibility that preps fixtures for future IoT مستشعر الإضاءة upgrades.

Zhaga-ready products allow integrators to add أجهزة استشعار الضوء without replacing fixtures — lowering the total cost of ownership. This drives repeat orders in industrial supply chains.

LED Panel Lights Still a Core Product in European Markets

LED panel lights remain strong in European commercial interiors. Their standard sizes and professional finish suit offices and retail. Market reports show sustained retrofit activity and new build projects in these regions.

Key factors include standardized installation and a dimmable option that helps with energy savings.

Smart-ready panels with sensor control and dimming provide energy savings and better occupant comfort — a strong pull factor for bulk procurement.

LED Bulbs Continue to Generate Massive Volume Despite Price Pressure

LED bulbs maintain heavy volume because cost savings and efficiency drive repeat buys. The global LED market was projected at $4.7 billion in 2025, with strong CAGR growth through 2032.

Connected and smart bulbs are a growing segment. Key drivers include:

● High turnover

Bulbs are low-ticket, high-frequency items.

● Smart variants

Wi-Fi, زيجبي, and Bluetooth models boost appeal.

● Bundling potential

Pairing bulbs with simple مفتاح الخلية الضوئية holders lifts value for B2B buyers.

Bundles increase order sizes and reduce commodity risk, giving wholesalers a margin edge.

T8 Tubes are the Preferred Choice for Retrofit Projects

These lights dominate retrofit lighting because they fit existing fluorescent fixtures without major rewiring. Global LED tube markets expect strong growth as building upgrades accelerate.

Market facts show T8 holds 40–55% of total LED tube demand. This is due to their lower energy and maintenance costs that drive decisions.

Energy service companies (ESCOs) favor T8 upgrades because ROI is fast and quantifiable.

LED Downlights Gaining Popularity in Hospitality and Commercial Design

LED downlights are increasingly specified in premium projects for light quality and efficiency. The integrated downlight segment is forecast to grow robustly by 2032.

Factors driving demand include:

● High CRI & glare control

Superior ambience in hospitality spaces.

● Regional preferences

Europe and Asia lead commercial installs.

● Smart readiness

Sensors and tunable white options add value.

Modern buildings prioritize operational savings and user comfort. This makes downlights a preferred choice.

LED Wall Packs Essential for Security and Outdoor Commercial Lighting

These lights are central to security, especially in North America. Strong safety codes and outdoor standards push volume.

Further, they are durable and in compliance with UL/DLC listings. Buyers often choose wall packs that include automatic control features, reducing manual operation costs.

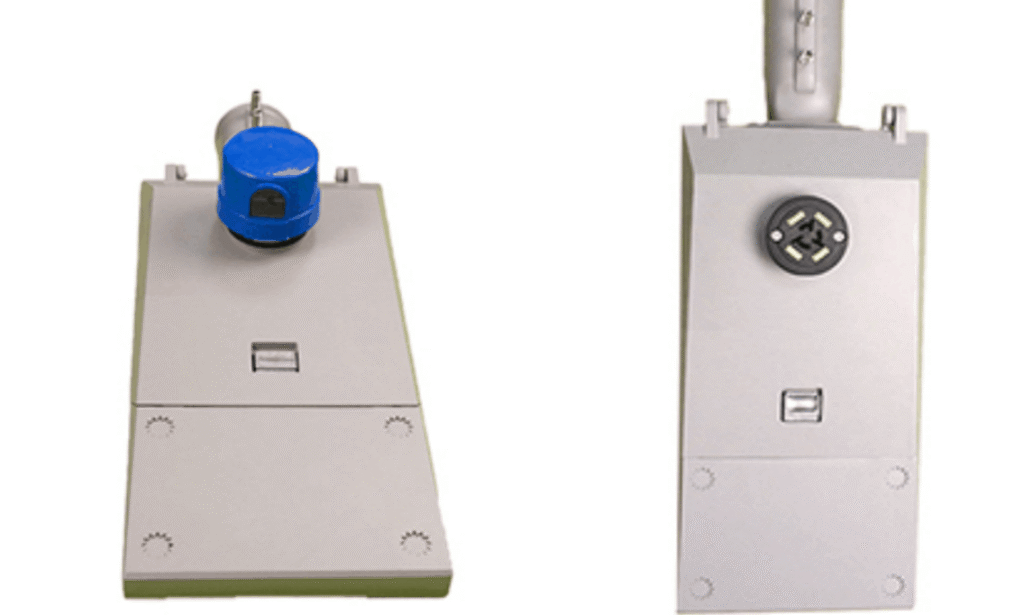

Lighting Accessories, like مستشعر ضوئي كهربائي and NEMA/Zhaga Sockets the Fastest-Growing Category

Lighting accessories are outperforming many fixtures because controls add recurring value. On Alibaba, RFQs for intelligent photocontrols and standardized sockets are rising fast.

Accessory growth factors:

● RFQ spikes

Control components show higher repeat inquiry rates.

● Long lifecycle

Once installed, these parts are rarely replaced, often locking in suppliers.

IoT adoption

- مفاتيح مستشعر الضوء and Zhaga interfaces now work with smart grids.

This category is less price-competitive and more loyalty-driven than basic luminaires.

How Do Price Competition, Certification Barriers, and Lifecycles Compare Across These 10 Categories?

| Lighting Category | Price Competition | Certification Barrier | Typical Gross Margin | Buyer Loyalty | Product Lifecycle | Strategic Value |

| LED Street Lights | عالي | Medium–High (UL, CE, ENEC) | واسطة | واسطة | واسطة | Project-driven, volume-focused |

| LED Flood Lights | عالي | واسطة | واسطة | منخفض-متوسط | واسطة | Strong retrofit demand |

| Solar Street Lights | واسطة | منخفض-متوسط | متوسط-عالي | واسطة | واسطة | Emerging markets, spec-sensitive |

| LED High Bay Lights | واسطة | High (UL, ENEC) | واسطة | متوسط-عالي | طويل | Industrial stability |

| LED Panel Lights | عالي | High (ENEC, ERP) | منخفض-متوسط | قليل | واسطة | European compliance-driven |

| LED Bulbs | عالية جدًا | قليل | قليل | منخفض جدًا | قصير | Commodity, volume-only |

| LED T8 Tubes | واسطة | واسطة | واسطة | واسطة | ESCO retrofit favorite | |

| LED Downlights | واسطة | متوسط-عالي | واسطة | واسطة | واسطة | Design and comfort focused |

| LED Wall Packs | واسطة | High (UL, DLC) | متوسط-عالي | عالي | طويل | Security and compliance-led |

| Accessories (Photocells, NEMA, Zhaga) | قليل | عالية جدًا | عالي | عالية جدًا | Very Long | System lock-in, repeat orders |

Why Are Lighting Accessories the Real Profit and Strategy Drivers in B2B Trade?

Lighting fixtures are becoming commoditized. Prices keep dropping. But accessories like photocells and smart controllers hold value longer and avoid price wars.

Market data shows the global Zhaga and نيما وحدات التحكم في الإضاءة market is expanding fast.

This is projected to grow from $1.7 billion in 2024 with a strong CAGR through 2033 due to smart lighting adoption.

Accessory demand is sticky because:

- Buyers often reorder the same control components for future projects.

- Controls install once but influence performance for years.

- IoT units connect to broader building systems.

For wholesalers and EPCs, this means better margins and stronger customer retention.

How Should Buyers and Manufacturers Position for Alibaba Lighting Growth in 2026? Key Takeaway

The lighting market is rapidly shifting toward solutions over standalone products. Smart controls and integrated sensors drive extended demand.

To win in 2026:

- Sell solutions and not just fixtures. Smart and adaptive systems outperform basic LEDs.

- Prioritize compliance. Energy efficiency and safety standards unlock project wins.

- Align with smart city goals. IoT lighting systems that reduce energy and integrate with cloud dashboards are now mainstream.

Manufacturers should embed control interfaces early. Buyers should specify connectivity and compliance upfront. Exporters must package long-term serviceability as a product differentiator.

الكلمات النهائية

Alibaba’s 2025 lighting trends make one thing clear. Fixtures are getting cheaper, but intelligent controls are becoming more valuable. For buyers and EPCs seeking extended reliability, choosing the right control partner matters. تشي-سوير, with its proven Long-Join photocontrollers, stands out as a dependable supplier for projects that demand compliance and consistent performance.

الروابط الخارجية

- https://www.ul.com/solutions

- https://en.wikipedia.org/wiki/CE_marking

- https://enec.com/what-is-the-enec-mark-2/

- https://www.iec.ch/ip-ratings

- https://zhagastandard.org/

- https://www.futuremarketreport.com/industry-report/networked-led-light-bulbs-market

- https://en.wikipedia.org/wiki/Zigbee

- https://www.nema.org/