Describir

- Introducción

- ¿Por qué Brasil es uno de los países más estratégicos para el desarrollo al aire libre? Control de iluminación ¿Mercado en América Latina?

- ¿Cuáles son las 10 principales empresas de iluminación exterior de Brasil en 2026?

- ¿Cuáles son las principales tendencias del mercado de iluminación exterior en Brasil para 2026?

- ¿Por qué el mercado de iluminación exterior de Brasil crea grandes oportunidades para los fabricantes de equipos originales (OEM) y los proveedores chinos?

- ¿Por qué es importante esta lista de las 10 principales empresas de iluminación exterior de Brasil para la planificación de 2026?

- Palabras finales

Brasil está experimentando un rápido crecimiento en su mercado de iluminación. Los controles inteligentes y los proyectos de APP impulsan principalmente este cambio.

El alumbrado público se está modernizando a una escala sin precedentes. Esto fomenta la competencia entre marcas globales y fabricantes locales.

Con la dinámica de iluminación cambiante y la inclusión de sensores de fotocélula de luz, Elegir a los socios adecuados ahora es más importante que nunca. Esta guía destaca las principales empresas de iluminación exterior que marcarán la pauta en Brasil en 2026.

¿Por qué Brasil es uno de los países más estratégicos para el desarrollo al aire libre? Control de iluminación ¿Mercado en América Latina?

Esta región está experimentando una rápida transformación. Ciudades de todo el país están reemplazando lámparas antiguas con sistemas LED eficientes. Este impulso está respaldado por importantes programas municipales y esfuerzos de modernización.

El alumbrado público es ahora un pilar fundamental de la infraestructura de las ciudades inteligentes. Muchas ciudades están integrando la monitorización remota y la conectividad IoT en el alumbrado público. Esto se está expandiendo más allá de la simple iluminación hacia servicios urbanos basados en datos.

Asociaciones público-privadas También son factores clave. Los contratos de colaboración público-privada (PPP) para mejoras de iluminación se han multiplicado. Esto atrae capital e inversión sostenida en soluciones de iluminación municipal.

Estas fuerzas combinadas convierten a Brasil en un mercado de alto crecimiento para las tecnologías de iluminación inteligente. A continuación, se presenta una tabla con algunas estadísticas relacionadas.

| Indicador | Datos/Estimación |

| Mercado de iluminación exterior en Brasil (2024) | 1.220 millones de dólares |

| Participación regional de la iluminación LED exterior en LATAM | La CAGR más alta de la región |

| Ingresos por alumbrado público en Brasil (2024) | USD 361,8 millones |

| Tasa de adopción de LED en el alumbrado público de Brasil | 19,6 % de lámparas son LED |

| Inversiones en alumbrado público PPP | >R$32 mil millones (2025) |

| Proyectos de APP municipales en marcha | 812 proyectos |

| % de la población atendida por concesiones de iluminación PPP | 27 % |

¿Cuáles son las 10 principales empresas de iluminación exterior de Brasil en 2026?

Para garantizar un verdadero liderazgo en el mercado, hemos utilizado criterios claros y medibles. La selección se basa en la demanda real del sector y las condiciones únicas del mercado brasileño, no en opiniones ni conjeturas.

Significar

Signify se destaca como líder global en iluminación con una sólida presencia local en Brasil y un sólido compromiso municipal. La credibilidad de su marca le permite conseguir importantes contratos de alumbrado público.

Las plataformas de ciudades inteligentes y las soluciones de iluminación conectada de la empresa impulsan la adopción de sistemas de control avanzados.

La historia de innovación y sustentabilidad de Signify lo posiciona por delante de sus competidores tanto en rendimiento LED como en sistemas exteriores integrados.

Iluminación WEG

La escala y la reputación de WEG en el sector eléctrico brasileño le otorgan una ventaja competitiva en proyectos de infraestructura. Su amplio portafolio y su fabricación local satisfacen las necesidades de iluminación gubernamental e industrial con sistemas duraderos.

El reconocimiento de WEG como innovador líder en Brasil también refleja su fortaleza en ingeniería y confiabilidad sostenida en aplicaciones exigentes.

Tecnowatt

Tecnowatt es conocida por sus eficientes luminarias LED para exteriores, ideales para calles y espacios públicos. La marca prioriza el rendimiento y la rentabilidad de sus productos, lo que la hace competitiva en licitaciones municipales.

Con diseños térmicos eficientes y opciones de montaje adaptables, sus soluciones de iluminación atraen a los gobiernos locales que buscan calidad y sensibilidad presupuestaria.

Iluminación de Blumenau

Blumenau Iluminação es una marca reconocida a nivel nacional en sistemas de iluminación para exteriores y paisajismo. Sus productos ofrecen un rendimiento confiable y altos índices de protección, ideales para instalaciones públicas y en espacios abiertos.

El portafolio de la empresa incluye luminarias LED certificadas construidas para cumplir con rigurosas condiciones exteriores, apoyando proyectos municipales y arquitectónicos en todo Brasil.

Iluminación Avant

Esta marca está ganando terreno gracias a su amplia gama de productos y a su red de distribución nacional. La empresa está presente en múltiples categorías de iluminación.

Sus alianzas y flexibilidad de diseño también impulsan el potencial de personalización, lo que refuerza su alcance en el mercado más allá de las luminarias estándar.

Ourolux

Ourolux es una de las marcas de iluminación más vendidas de Brasil, líder en ventas de lámparas LED en todas las regiones, según estudios de mercado. Sus productos son conocidos por su excelente rendimiento a precios asequibles, lo que los hace atractivos para licitaciones de modernización y proyectos municipales con presupuestos ajustados.

Ourolux también se adapta a las condiciones climáticas tropicales con diseños robustos y amplia disponibilidad de productos.

El creciente enfoque de la marca en la integración de LED y la eficiencia energética controles de iluminación Ayuda a ofrecer un rendimiento sólido en las actualizaciones del alumbrado público.

Luz G

G-Light es un importante fabricante brasileño de iluminación LED con presencia nacional y una producción que supera el millón de luminarias al año.

La gama incluye todos los productos de iluminación exterior adecuados para infraestructuras públicas. Los precios competitivos de la empresa y ISO La certificación la convierte en una opción frecuente en licitaciones gubernamentales y grandes proyectos.

La empresa también invierte en tecnologías LED eficientes y duraderas, adaptadas a las condiciones brasileñas. Esto mejora el valor del proyecto y su rendimiento a largo plazo.

Luminatti

Luminatti se centra en soluciones LED versátiles que combinan estética y rendimiento fiable. Esto satisface las necesidades de iluminación pública y paisajística. Su catálogo incluye luminarias y accesorios modernos diseñados para una fácil instalación y una larga vida útil.

La marca prioriza productos sostenibles y de bajo consumo energético. Esto se alinea con la transición de Brasil hacia la eficiencia y el embellecimiento de la iluminación exterior. Los diseños de Luminatti apoyan proyectos donde el impacto visual y la durabilidad son fundamentales.

Brilia

Esta empresa de iluminación LED de Brasil tiene una línea de productos diversa que abarca aplicaciones residenciales e industriales.

La capacidad de ingeniería y la calidad de sus productos la posicionan como una excelente opción para la iluminación exterior, tanto arquitectónica como de exteriores. Brilia ofrece excelentes soluciones LED diseñadas para diversos entornos.

Su enfoque en el desarrollo de iluminación orientado a proyectos y la expansión de sistemas de control respalda el crecimiento hacia aplicaciones inteligentes para exteriores más allá de los mercados comerciales tradicionales.

Zagonel

Este fabricante brasileño de iluminación tiene un sólido portafolio de luminarias LED profesionales para uso industrial y público.

Sus productos incluyen luminarias y sistemas diseñados para ofrecer durabilidad y fiabilidad en entornos hostiles. Zagonel también desarrolla productos de iluminación inteligente y sistemas integrados. Esto refleja la creciente demanda del mercado de conectividad y control.

Su participación en eventos nacionales de diseño de iluminación y premios de productos resalta su compromiso con el rendimiento y la innovación en el sector de la iluminación.

¿Cuáles son las principales tendencias del mercado de iluminación exterior en Brasil para 2026?

Las mejoras en el alumbrado público inteligente y LED están transformando las ciudades brasileñas

Las ciudades brasileñas están modernizando sus sistemas de iluminación de forma intensiva. La razón es simple: el bajo consumo de energía y los costos de mantenimiento son inmediatos.

Grandes capitales como São Paulo y Salvador ya están inmersas en programas de conversión a LED. Muchos proyectos se estructuran mediante contratos de APP sostenidos. Esto garantiza una financiación estable y una implementación más rápida.

Al mismo tiempo, la iluminación inteligente con interruptores de fotocélula se está volviendo estándar, no opcional. Las licitaciones municipales especifican cada vez más la preparación inteligente.

Los factores clave de actualización incluyen:

- Mandatos de reemplazo de HID a LED a gran escala

- Obligatorio NEMA Tomas de 7 pines para fotosensores para futuras actualizaciones de control

- Monitoreo centralizado de activos de iluminación gestionados por PPP

La siguiente tabla describe algunas estandarizaciones importantes y su importancia en el contexto de Brasil.

| Estándar | Uso típico en Brasil | Por qué es importante |

| NEMA de 7 pines | Alumbrado público municipal | Fácil reemplazo y actualizaciones del controlador |

| Libro Zhaga-18 | Ciudades inteligentes y proyectos preparados para el futuro | Compacto, modular, compatibilidad global |

| Atenuación de 0 a 10 V | Modernizaciones inteligentes básicas | Control de iluminación rentable |

| Dalí-2 | Distritos inteligentes limitados | Control avanzado, mayor coste del sistema |

| Nodos inalámbricos | Proyectos APP | Monitoreo y diagnóstico centralizados |

Las condiciones climáticas de Brasil exigen mayor durabilidad de la iluminación exterior

El clima de Brasil es implacable para los equipos de iluminación exterior. La alta humedad predomina en la mayoría de las regiones. Las ciudades costeras se exponen constantemente a la salinidad. Las zonas del interior se enfrentan a calor extremo y radiación ultravioleta. Estas condiciones exponen rápidamente los diseños frágiles.

Como resultado, los municipios ahora exigen estándares de durabilidad más altos para interruptores de fotocélula de luz exterior. Las fallas de iluminación se traducen directamente en quejas públicas y sanciones de mantenimiento en virtud de los contratos PPP.

La inversión en infraestructura para polos inteligentes y ciudades inteligentes se expande

El alumbrado público en Brasil se está convirtiendo en postes inteligentes multifuncionales. Las ciudades ahora utilizan los postes como centros de infraestructura, no solo como soportes de iluminación. Los presupuestos de las ciudades inteligentes integran cada vez más la iluminación con los servicios digitales.

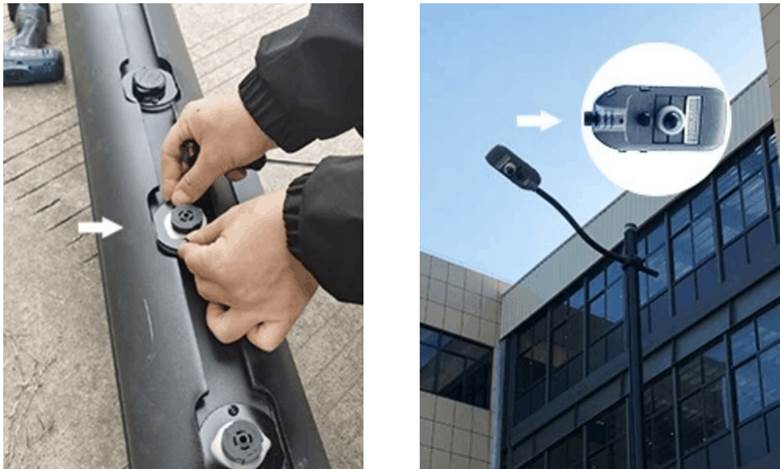

Con la ayuda de fotocontroles, Los postes inteligentes modernos suelen integrar:

- Luminarias LED con regulación remota

- Sensores ambientales y de tráfico

- Cámaras de CCTV y seguridad pública

- Instalaciones públicas de internet

Para permitir esta flexibilidad, las ciudades prefieren interfaces estandarizadas. NEMA y Zhaga sensores de luz automáticos Permite actualizaciones rápidas sin reemplazar luminarias.

Este enfoque modular reduce los costos a largo plazo y mantiene la adaptabilidad de los activos. Los postes inteligentes se están convirtiendo en la columna vertebral de la capa digital urbana de Brasil. La siguiente tabla muestra diversos módulos inteligentes y su compatibilidad con diversas interfaces.

| Módulo inteligente | Función | Interfaz típica |

| Nodo de fotocontrol | Encendido/apagado automático y atenuación | NEMA / Zhaga |

| Sensor ambiental | Aire, ruido, clima | Zhaga |

| Cámara de CCTV | Seguridad pública | Montado en poste |

| Unidad de Comunicación | NB-IoT / LoRa / 5G | Nodo NEMA |

| Medidor de energía | Monitoreo de energía | Controlador integrado |

El rendimiento y la rentabilidad son los principales impulsores de las adquisiciones

Los municipios brasileños operan bajo una fuerte presión financiera. Los presupuestos son objeto de escrutinio. El valor a largo plazo es más importante que el costo inicial. Por eso, las decisiones de adquisición se centran principalmente en el rendimiento del ciclo de vida.

Las autoridades ahora priorizan:

- Alta eficacia lumínica para reducir las facturas de energía

- Largo control del sensor de luz vida útil para limitar los reemplazos

- Fiabilidad comprobada para evitar sanciones PPP

- Soporte posventa local para una respuesta más rápida

El precio más bajo por sí solo ya no es suficiente para ganar licitaciones. Las ciudades calculan el costo total de propiedad a lo largo de 10 a 20 años. Los proveedores que equilibran rendimiento, durabilidad y disponibilidad de servicio superan constantemente a sus competidores de bajo costo.

¿Por qué el mercado de iluminación exterior de Brasil crea grandes oportunidades para los fabricantes de equipos originales (OEM) y los proveedores chinos?

La demanda de iluminación exterior en Brasil crece a un ritmo superior a la capacidad de suministro local. Las mejoras municipales requieren grandes cantidades de componentes, no solo luminarias. Esto crea claras oportunidades de entrada para fabricantes de equipos originales (OEM) y chinos, con ventajas de escala y costo.

Interruptores de sensor de luz exterior Los controladores inteligentes tienen una demanda especialmente alta. Muchas marcas brasileñas los contratan externamente para cumplir con los plazos de las APP. Los ecosistemas NEMA y Zhaga gozan de amplia aceptación, lo que reduce las barreras de integración.

Las áreas de oportunidad clave incluyen:

- Sensor de fotointerruptor, Nodos NEMA de 7 pines, y Controladores Zhaga

- Módulos inteligentes para atenuación, detección y monitoreo

- Cooperación ODM con marcas brasileñas locales

- Contratos de suministro a largo plazo en el marco de las APP

Para los proveedores que entienden los estándares y la certificación, Brasil es un mercado de alto potencial.

¿Por qué es importante esta lista de las 10 principales empresas de iluminación exterior de Brasil para la planificación de 2026?

El mercado brasileño de iluminación es saturado y desigual. No todas las marcas son relevantes para grandes proyectos públicos o de ciudades inteligentes. Esta lista filtra la señal del ruido.

Ayuda a las partes interesadas a identificar rápidamente quién influye realmente en las decisiones de adquisición e implementación. Los contratistas de EPC pueden identificar marcas activas en PPP. Los proveedores OEM pueden centrarse en compradores que ya utilizan sistemas NEMA o Zhaga.

Esta lista admite:

- Selección más rápida de socios para licitaciones EPC

- Selección más inteligente de proveedores para acuerdos OEM/ODM

- Mejor alineación con marcas preparadas para lo inteligente

- Planificación estratégica para Brasil

En un mercado dinámico, la claridad ahorra tiempo. Esta lista proporciona esa claridad para las decisiones de 2026.

Palabras finales

El mercado brasileño de iluminación exterior está en plena evolución. Las actualizaciones LED y los controles inteligentes ya son estándar, no opcionales. Para proyectos que utilizan fotocontroladores de unión larga, la fiabilidad del proveedor es fundamental. Chi-Swear Ofrece calidad constante y experiencia en proyectos. Esto la convierte en una opción confiable para instalaciones de iluminación en Brasil.

Enlaces externos

- https://en.wikipedia.org/wiki/Public%E2%80%93private_partnership

- https://deepmarketinsights.com/vista/insights/outdoor-lighting-market/brazil

- https://www.grandviewresearch.com/horizon/outlook/outdoor-lighting-market/latin-america

- https://www.iso.org/home.html

- https://www.nema.org/

- https://www.zhagastandard.org/books/overview/smart-interface-between-outdoor-luminaires-and-sensing-communication-modules-18.html

- https://en.wikipedia.org/wiki/0-10_V_lighting_control

- https://www.dali-alliance.org/

- https://en.wikipedia.org/wiki/Narrowband_IoT

- https://lora-alliance.org/\