Outline

- Introduction

- Why Is South America a Rapidly Growing Market for Smart Lighting?

- What Makes Brazil the Rapidly Growing Lighting Market in South America?

- How Is Brazil Transforming Its Street Lighting Infrastructure?

- What Is Driving Market Demand for Photosensors & Smart Photocontrols in Brazil?

- How Do Photoelectric Sensors Support the Future of Smart Lighting in Brazil?

- Why Is Now the Best Time for Photocell Manufacturers to Enter Brazil?

- How Can Manufacturers Position Themselves to Win in the Brazilian Market?

- What Does Brazil’s Smart Lighting Future Mean for Global Suppliers?

- Final Words

South America is stepping into a new era of smart lighting. Cities are replacing old street lamps with efficient LED systems and modern light sensor photocell switches.

But why is this shift happening now, and why is Brazil the most rapidly growing market in the region?

The answer lies in its strong energy policies and rapid smart city development. As municipalities upgrade their networks, the demand for reliable photocells and NEMA/Zhaga controllers is rising fast. For global suppliers, this moment presents a rare and promising opportunity.

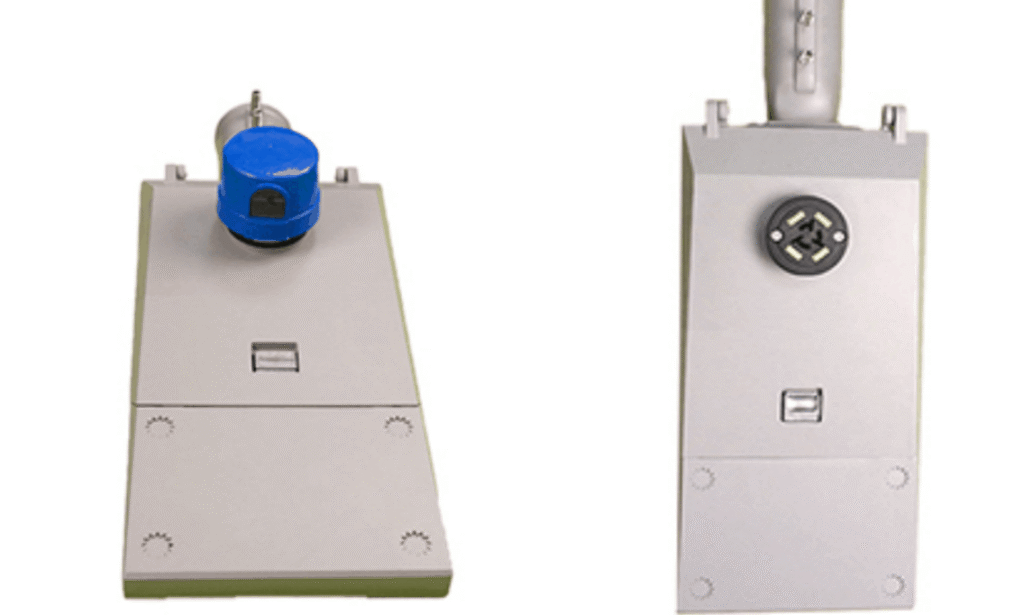

Photo courtesy: Joripress

Why Is South America a Rapidly Growing Market for Smart Lighting?

Multiple factors are driving this change. To start with, South America’s rapidly modernizing public infrastructure is a primary driver. Municipal budgets now prioritise energy savings and public safety. Brazil is leading with large LED retrofit programmes and city PPPs that replace sodium lamps with LEDs.

National policy and tech strategy push smart services. Brazil’s National IoT plan explicitly includes smart cities and lighting as priority areas.

Procurement rules in major tenders increasingly require intelligent interfaces. Many projects demand NEMA and Zhaga sockets for remote dimming and telemetry.

Regulatory compliance is also critical. INMETRO certification is mandatory for lighting imports and market access. Together, these trends create steady, high-volume demand for reliable photocells and smart controllers across the continent.

What Makes Brazil the Rapidly Growing Lighting Market in South America?

Here are some statistics illustrating the current state of Brazil’s lighting market.

- In 2024, it was valued at USD 2.8 billion.

- By 2033, it is projected to reach USD 7.3 billion.

- This growth is at a CAGR of roughly 10.65% from 2025 to 2033.

Several factors drive this surge:

- Large national LED retrofit programs are aiming to replace outdated lighting systems across cities.

- There is a growing demand for remote lighting management. Often referred to as “Tele Gestão,” this aims to improve energy efficiency and reduce maintenance costs.

- A rising requirement for modern lighting hardware. Many public tenders now specify NEMA bases or Zhaga Book 18 sockets to enable smart controllers and IoT connectivity. This fuels demand for compatible photocells and control gear.

How Is Brazil Transforming Its Street Lighting Infrastructure?

Cities are replacing sodium-vapor lamps with LED luminaires at scale. Large municipal tenders and national retrofit programmes drive this.

Brazil already manages millions of public light points, so upgrades move the needle fast. Public tenders now include clear hardware and connectivity rules:

- NEMA bases and Zhaga sockets are frequently required for remote control.

- Controllers use advanced communication protocols for telemetry and remote dimming. They include:

-

- RF-mesh

- INMETRO certification is mandatory for market access and procurement.

- Projects specify robust surge protection because grid instability and lightning risk are real concerns. Recommended specs commonly call for high-capacity SPDs.

These combined requirements create high, recurring demand for certified, rugged photocontrols and smart controllers.

What Is Driving Market Demand for Photosensors & Smart Photocontrols in Brazil?

Public Lighting PPPs Create Recurring Demand

Public-private partnerships are fueling Brazil’s street-lighting transformation. International Finance Corporation and CAIXA have helped structure many of these PPPs.

These PPPs mandate LED upgrades and smart control systems for thousands of street lights.

Municipalities often require photocells/photocontrol gear in every contract. This makes demand for these components stable and recurring — not a one-time purchase.

Smart City Projects Accelerating Lighting Controls Adoption

Brazil’s shift to smart cities is real. Public lighting is now seen as part of a city’s digital backbone.

Light sensor switches and smart controllers act as data-nodes. They enable remote monitoring, adaptive dimming, and integration with IoT systems or even 5G-enabled lights.

As more cities adopt tele-management, the value of compliant photocontrol hardware keeps rising.

Opportunities Exist for International and Asian Suppliers

Although global brands currently dominate the lighting market, Brazil’s PPP and smart-city wave leaves a gap for cost-efficient, certified suppliers. Many municipalities and integrators now seek OEM/ODM partners for flexible, tailored photocell/photocontrol solutions.

Demand isn’t just for basic sensors — there’s a rising need for devices compatible with remote management, surge protection, and smart-city integration. Suppliers offering such packages stand to gain traction.

How Do Photoelectric Sensors Support the Future of Smart Lighting in Brazil?

Photo switch sensors and smart controllers play a key role in making Brazil’s street lighting future-ready

Reliability and low maintenance

LED + smart control can cut energy consumption by up to 50–70%. LEDs and quality photocells last far longer than traditional lamps — reducing maintenance, replacement, and labour costs.

Smart sockets for IoT and dimming

Use of standard sockets such as NEMA and Zhaga enables easy interoperability. These controllers enable dimming and connectivity over various communication protocols.

Scalable deployment, from towns to large cities

Smart LED + photocell setups suit small municipalities and megacities alike. Demand spans residential areas to busy highways.

Sustainability goals

Intelligent lighting slashes energy use and CO₂ output. Municipal lighting accounts for a major share of city energy — making smart lighting pivotal for emissions reduction.

Further, here is a table of comparison of photocell lifespan vs maintenance frequency in Brazilian cities.

| Photocell Type | Electromechanical | Electronic Standard | Smart NEMA 7-Pin | Zhaga Book 18 Node |

| Average Lifespan (Years) | 3–5 | 8–10 | 10–12 | 10–12 |

| Annual Maintenance Visits | 2–3 | 1–2 | 1 | 1 |

| Expected Failure Rate (%) | 12–18% | 5–8% | 3–5% | 2–4% |

| Suitability for Smart Projects | Low | Medium | High | Very High |

Why Is Now the Best Time for Photocell Manufacturers to Enter Brazil?

Brazil’s smart-street lighting transition is still in the early-to-mid phase. Public lighting PPPs and smart-city tenders are rolling out now across many municipalities.

New suppliers have several advantages:

- Municipal contracts increasingly demand INMETRO certification and globally accepted standards.

- Products compliant with UL and CE norms stand out in procurement evaluations.

- Demand exists for OEM/ODM customization. This is especially applicable where integrators need tailored photocells for specific city requirements.

- Suppliers who deliver a strong cost-performance balance — combining certification, reliability, and competitive pricing — can win over cost-sensitive municipalities.

How Can Manufacturers Position Themselves to Win in the Brazilian Market?

Below are some steps to achieve this goal:

Partnerships

Partner with local EPCs and PPP managers. Local firms know the procurement processes and regulatory landscape better. Their networks and relationships can help foreign suppliers navigate complex tendering procedures.

Offer full photo control portfolios

Include NEMA-compatible, Zhaga-ready, and smart controllers in your catalog. This ensures coverage of all common project requirements — from simple retrofits to full smart-city lighting systems.

Ensure regulatory and safety compliance

INMETRO certification is your gateway to entering the Brazilian market. Without it, imports will be blocked.

Highlight energy-saving potential

Show how your lighting solutions reduce energy costs, enable remote management, and support the long-term goals of municipalities. That aligns well with Brazil’s push for efficient, modern public lighting.

What Does Brazil’s Smart Lighting Future Mean for Global Suppliers?

Brazil is becoming the gateway to smart-lighting adoption across Latin America. Its growing market gives global suppliers a strategic springboard to expand regionally.

- The “smart-pole” segment alone is forecast to grow from USD 285 million in 2023 to USD 1,046 million by 2030.

- There is export potential to other South American markets by using Brazil as a regional base.

- This outlook shows smart street lights evolving into multifunctional infrastructure. Lighting + IoT sensors + EV charging + environmental monitoring on smart-poles.

Light photocell sensor manufacturers have a competitive edge now. Many Brazilian tenders still lack enough certified, flexible suppliers. Early entrants offering compliant, cost-effective smart controllers and photocells can secure long-term contracts.

This early-market advantage makes now the ideal time for global suppliers to expand into Brazil’s smart lighting ecosystem. Here is a table outlining emerging smart lighting trends in Brazil.

| Trend | Adoption Speed | Key Drivers | What It Means for Photocell Suppliers |

| Smart Poles | Fast | 5G rollout, public safety | Demand for Zhaga/NEMA hybrid designs |

| Sensor-Driven Dimming | Medium | Energy savings targets | Higher need for smart-ready photocells |

| Solar + Battery Street Lights | Medium-Fast | Rural electrification | New photocell wiring configurations |

| City-Wide CMS Platforms | Fast | IoT funding and PPPs | More demand for interoperable controllers |

Final Words

Brazil’s smart street lighting market is growing fast. Early entrants can secure a strong foothold with certified, reliable products. For quality Long-Join photocontrollers, Chi-Swear offers dependable solutions that meet INMETRO and global standards — making them an ideal partner for your Brazilian projects.

External Links

- https://www.nema.org/

- https://zhagastandard.org/

- https://www.tuvsud.com/en-us/services/product-certification/inmetro

- https://joripress.com/brazil-led-market

- https://www.imarcgroup.com/global-brazil-led-market

- https://en.wikipedia.org/wiki/Narrowband_IoT

- https://lora-alliance.org/

- https://www.ifc.org/en/home

- https://www.grandviewresearch.com/horizon/outlook/smart-pole-market/brazil